Five Trends That Could Transform Your Global Supply Chain in 2019

1. Tariffs and geopolitical uncertainty will increase supply chain complexity

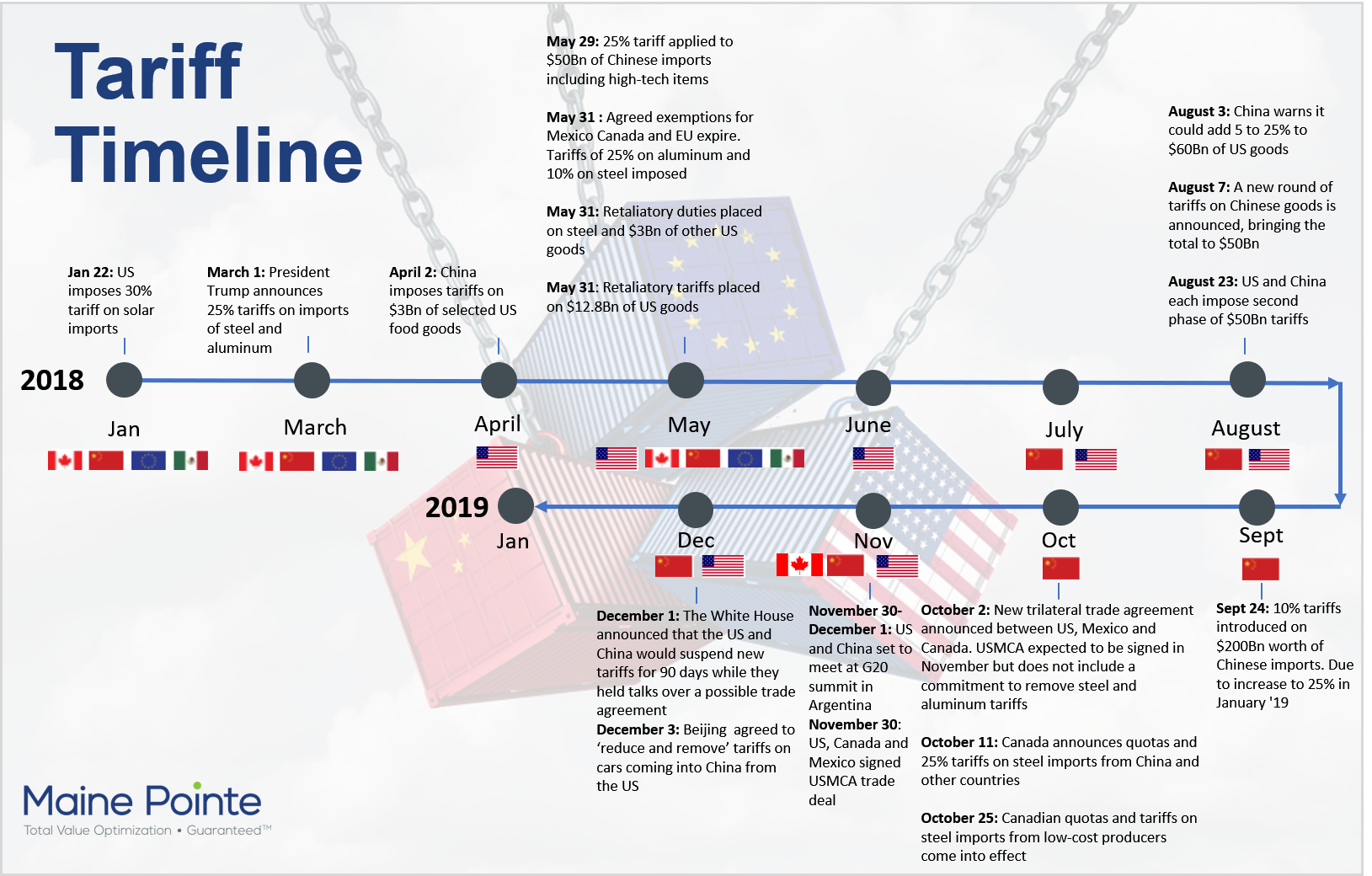

In 2018, we saw the dawn of a new era of tariffs, protectionism and trade wars that is already having a significant impact on global economies and supply chains. As 2019 unfolds, these effects will be far-reaching and businesses that have thus far been relatively untouched will start to feel the effects. As a result, we will see the resurgence of tariff engineering along with an increase in supply chain complexity.

The complications arising from new tariffs will require leadership to take a more sophisticated, data-led approach to analyzing spend and achieving sustainable cost savings. In addition, businesses will need to understand who their supplier's suppliers and their customer's customers are so that they can predict potential disruptions to the supply chain and have alternatives in place. Forward-looking CEOs are already looking to build new relationships with their supply chain to deal with the existing tariffs and prepare for whatever comes their way.

2. The next global recession is on the horizon

As trade disputes between the US and its key trading partners escalate, it seems almost inevitable that growth will slow. This will be exacerbated by geopolitical factors such as Brexit, civil unrest in France, declining oil prices and a faltering Chinese market, leading to concerns over a global economic downturn. In December 2018, investor sentiment in the eurozone fell to its lowest level in four years and many US analysts are warning that storm clouds are gathering, with some predicting the next global recession will hit by 2020. Forward planning is the key to survival. In essence, businesses can take advantage of today's, mostly good, economy to prepare their supply chain for a weakening economy.

3. The drive towards IOT/Industry 4.0 will accelerate

The Internet of Things (IoT) and Industry 4.0 are revolutionizing the way companies do business. This drive towards IOT/industry 4.0 will accelerate in the year ahead as manufacturers, distributors and retailers look to increase digitization to deliver visibility and efficiencies across the buy-make-move-fulfill supply chain.

Enabling technologies significantly disrupt traditional business models, as evidenced by the 'Amazon effect“. Companies that respond to these dynamics are thriving, whilst others struggle to survive.

While market-leading CEOs are continuously searching for ways to become more technologically advanced and leverage data for advantage, others have been slower to adapt. According to a December 2018 report by Watson Supply Chain Insights, 84% of chief supply chain officers report that lack of visibility is their biggest challenge and 87% report lack of data visibility makes it difficult to predict and proactively manage disruptions.

The information revolution is accelerating the imperative for companies to develop a competitive edge by building unique competencies while relentlessly driving productivity, efficiency and innovation in their organizations. This means companies must inevitably rely on external partners to achieve their business objectives. Therefore, success ultimately depends on collaborating effectively with upstream and downstream partners to deliver value to the market.

4. The global supply chain skills gap will become a skills crisis

Another challenge that had been impacting supply chains for a number of years and isn't going away any time soon is the problem of attracting and retaining the right talent. The shortage of supply chain talent is escalating from a skills gap to a potential skills crisis as manufacturing, retail, logistics, and a range of other companies scramble to find supply chain professionals. Companies that want to compete in the global arena, need to solve this problem fast. Failure to do so could threaten their very existence.

Last year, a DHL survey of 350 supply chain professionals in five global regions revealed the top factors driving the talent shortage were:

- Changing skill requirements

- An aging workforce (baby boomer retirement)

- Companies not taking steps to create or feed their future talent pipeline

- A perception that supply chain jobs lack excitement

To combat these issues, businesses will need to change their hiring methods to attract and retain the people who can help them transition to the digital age. Companies tend to view their supply chains as a cost center and not strategic, and that perception needs to change. This kind of change doesn't come easily, and businesses will be under increasing pressure to align both leadership and workforce behind evolving business strategies/models and supply chain transformation efforts.

5. Supply chain optionality and the need for supply chain integration will increase in importance

Now is the time to be proactive to protect margins and get actionable insights into the end-to-end supply chain and operations. A research white paper from the Global Supply Chain Institute (GSCI), University of Tennessee, Supply Chain Integration Strategy Best Practices (November 2018) found that benchmark supply chains have reported moving to integrated end-to-end supply chain designs under a single corporate executive. The paper identifies the eight best practices for businesses looking to create an integrated, end-to-end supply chain.

Integrated structures create a common strategy, vision, and culture focused on total value; this first step on the integration journey frequently delivers increased value and improved performance.“ (Supply Chain Integration Best Practices, GSCI).

Many executives recognize the need to change, some have even taken the first steps towards Total Value Optimization™. Others still struggle to synchronize siloed procurement, manufacturing, logistics and fulfillment operations to anticipate demand and effectively meet customer requirements. To achieve this, executives need to:

- Optimize supply chain and operations efficiency - Irrespective of the global trade war, there are still significant opportunities for companies to drive out cost, release cash and enable growth in the end-end supply chain

- Improve supply chain optionality. The smart move is to balance risk by exploring sourcing opportunities in countries that are not affected by the tariffs. In addition, in some areas, now is the time to negotiate the best possible deals on any raw materials, intermediate or finished goods that are not impacted by tariffs

- Gain market insights regarding shifting production facilities. Assessing the viability of shifting production facilities to avoid tariffs is a more medium-term strategy for executives to consider

What next?

Smart companies are taking a holistic, Total Value Optimization™ approach to assessing their end-to-end supply chain. This enables them to:

- Address import and tariff risks through multi-country sourcing assessments

- Create value stream visibility to accelerate transition to best total value alternatives

- Identify opportunities to improve supplier optionality and mitigate against an uplift in costs

- Unearth inefficiencies across procurement, logistics and operations environments

- Eradicate cross-functional bottlenecks and functional silos

- Drive synergy savings and service improvements

- Enhance collaboration with suppliers, partners and customers

Being proactive is imperative to corporate survival and profitability as markets, technology and supply chains shift. If you haven't already done so, we recommend you conduct a thorough assessment of your end-to-end supply chain.

Our industry and delivery practice experts can help. Contact us to arrange an in-depth Total Value Optimization™ (TVO) analysis across your buy-make-move-fulfill supply chain.

Alternatively, learn more about how the TVO framework provides a clear pathway to transform your supply chain into a competitive weapon, read Steven Bowen's Total Value Optimization Book.