MAXIMIZING ESG ROI THROUGH ADVANCED ANALYTICS: UNLOCKING THE TRUE POTENTIAL

Balancing the expense and reward of environmental, social, and governance efforts

Many C-suite executives struggle to ensure the return on investment (ROI) of ESG. Their efforts would be considerably easier if they could:

- Verify the accuracy of ESG data.

- Monitor the impact of each ESG initiative.

- Calculate the real ESG ROI.

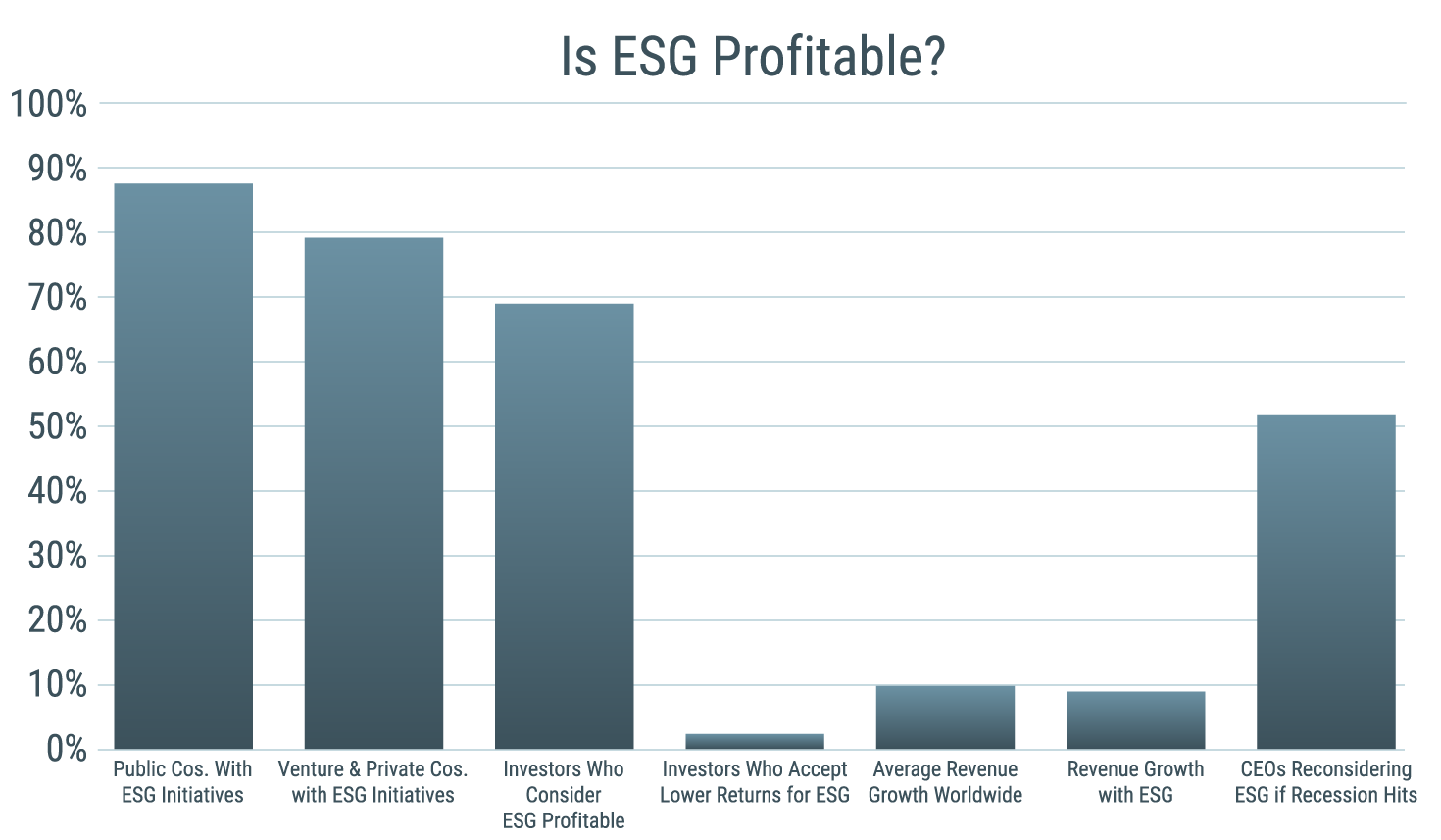

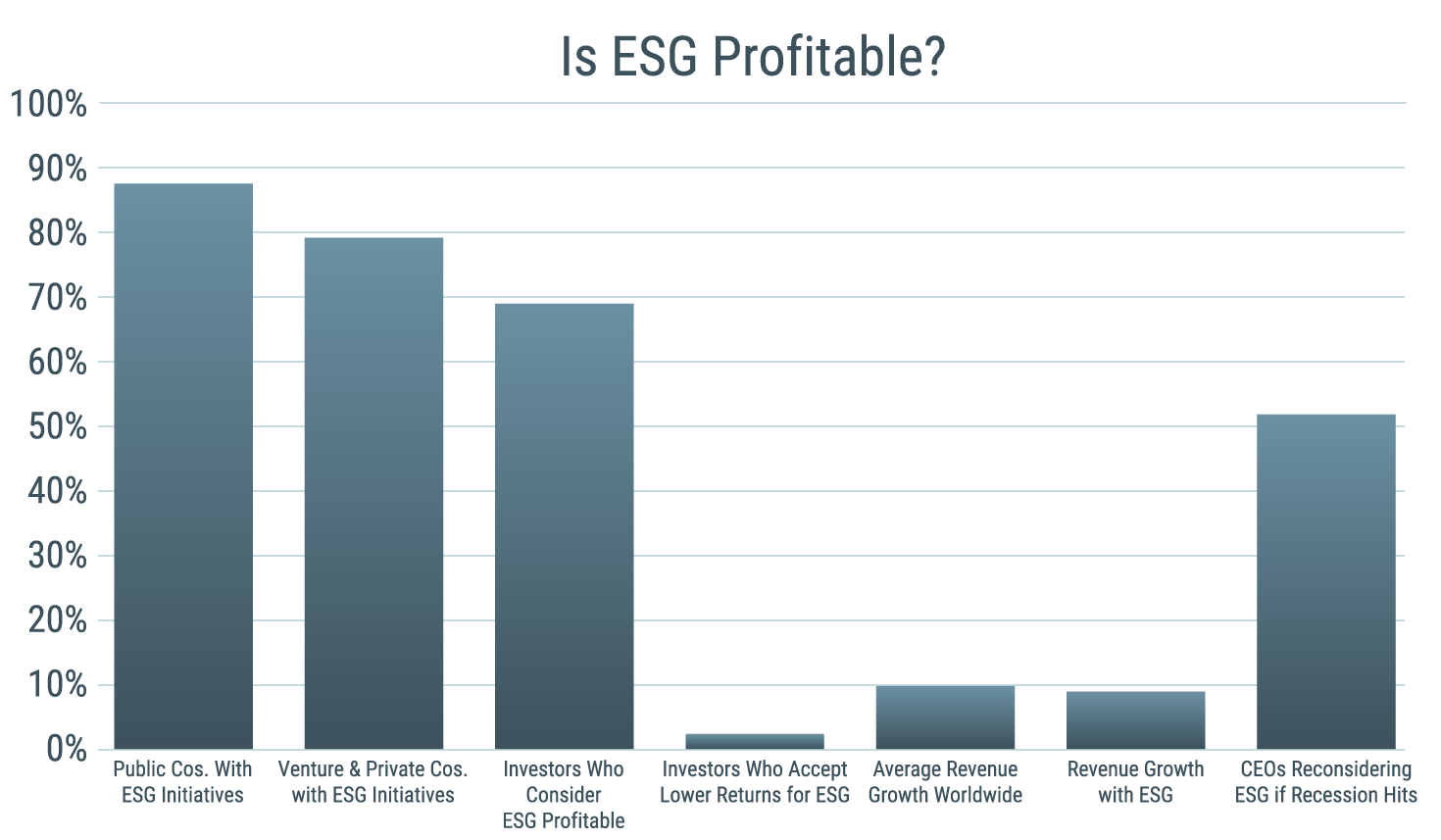

Up to 90% of companies claim to engage in environmental, social, and governance (ESG) initiatives. Yet 59% are prepared to abandon those plans if a recession hits. If ESG efforts are going to continue, and if they are worth continuing, the C-suite needs:

- A way to measure the ROI of ESG and its impact on the profitability of procurement, operations, logistics, and investments.

- A way to determine how ESG initiatives fit into and affect their end-to-end supply chain in the long term.

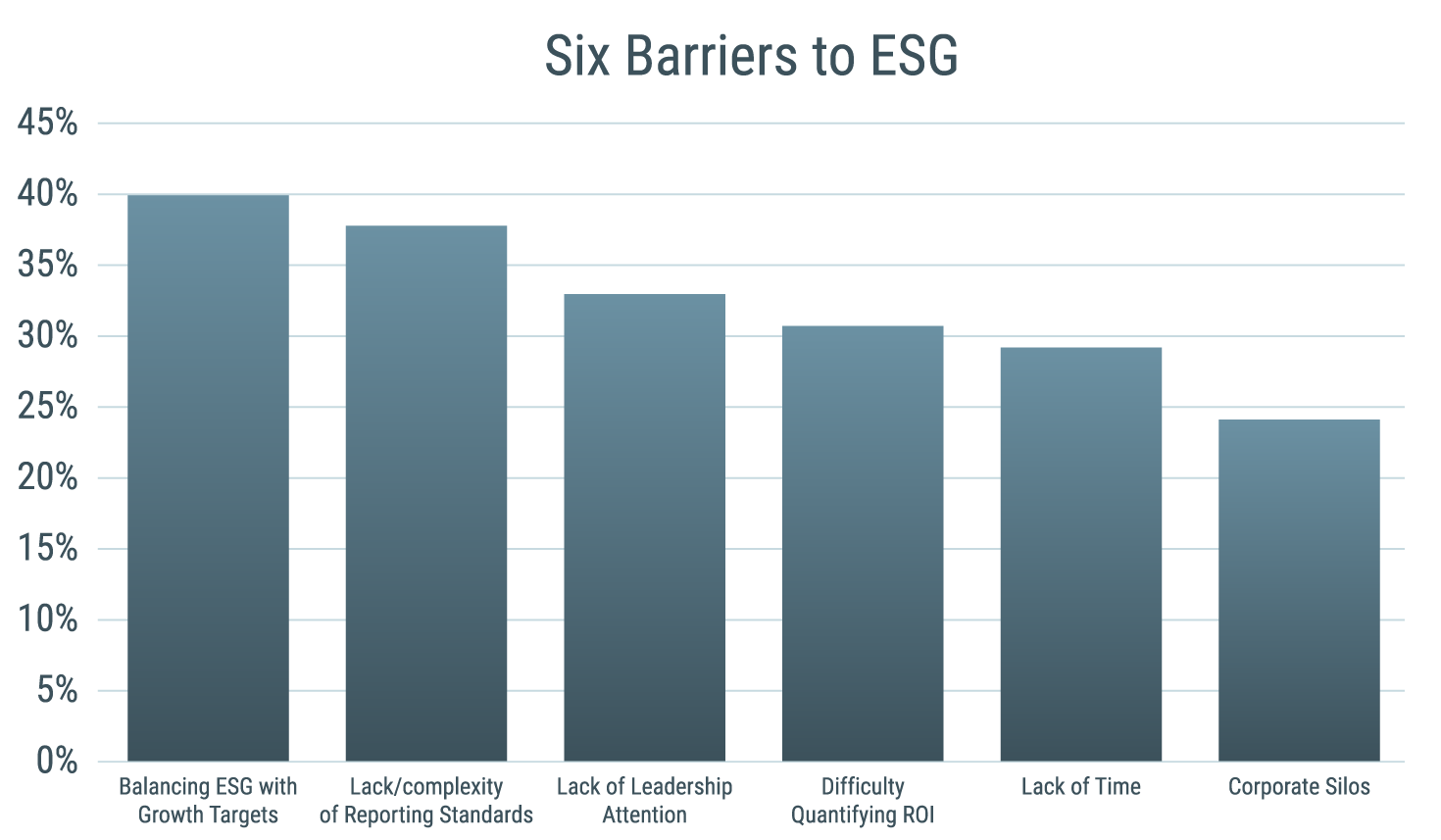

What are the barriers to ESG?

difficulty of meeting growth targets as the most important barrier to effecting ESG change; the difficulty of quantifying ROI is fourth.

Right now, most analyses consider the trillions of dollars invested in companies with ESG strategies to be the chief indication that those strategies are profitable. But in many ways, the investment community is acting blindly: data is difficult to access, the initiatives themselves are often not clearly defined, and consistent metrics are still under development.

The financial cost and profit of ESG for most business has become buried in the total cost of doing business until disaster strikes, as with the Nike sweatshops, self-driving electric cars that cause accidents, and the ethical disasters of the cybercurrency industry. In such cases, the negative reactions by customers can devastate net earnings, especially if the company was previously viewed with skepticism.

The International Financial Reporting Standards (IFRS) Foundation, Sustainability Accounting Standards Board (SASB), and the World Economic Forum (WEF) are all seeking standardized methods for disclosing and measuring financial information related to ESG and sustainability initiatives. They wish to “help companies provide a holistic view of their value creation story, incorporating both an inside-out perspective—capturing a company’s impacts on the environment, society, and economy—as well as an outside-in perspective—measuring the impacts of environmental, social, and macroeconomic trends on the company.”1

The spread of consistent metrics and the inclusion of oversight have both advanced slowly: only 120 companies worldwide use the WEB metrics.2 That slow rate of acceptance is odd, given that executives in multiple countries identify the lack of reporting standards as one of the biggest barriers to ESG progress.

Nathanael Powrie is responsible for helping our clients leverage the real power of data analytics through implementation engagements or by delivering advanced analytics solutions. Nathanael has more than a decade of expertise in helping companies across a wide range of industries including automotive, chemical, oil and gas, and industrial manufacturing, leverage advanced analytics to redesign their business models and drive cost reductions.

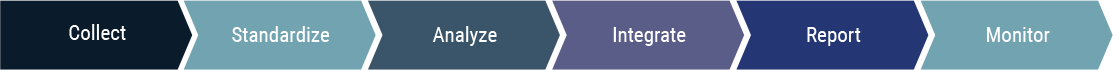

Six steps to embrace a data-driven approach for ESG

Data collection

Collect ESG data from various sources such as sustainability reports, annual reports, regulatory filings, and third-party data providers. The data should be reliable, accurate, and relevant to the specific ESG issue in question.

Data standardization

Standardize the ESG data to ensure comparability across companies and industries. This can be achieved using industry-recognized metrics and frameworks, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

Data analysis

Analyze the ESG data using appropriate statistical methods to identify patterns, trends, and relationships. This can involve the use of statistical software, data visualization tools, and machine learning algorithms.

Data integration

Integrate ESG data with financial data to understand the potential impact of ESG issues on a company's financial performance. This can help to assess the risks and opportunities associated with ESG factors and inform decision-making.

Data reporting

Report the ESG data in a transparent and accessible manner to stakeholders, such as investors, customers, and employees. This can help to build trust and credibility and provide a basis for ongoing commitment.

Data monitoring

Monitor ESG data on an ongoing basis to track progress and identify areas for improvement. This can involve the use of ESG rating agencies, benchmarking against peers, and setting targets for ESG performance

Data-Driven Approach to ESG

Guaranteeing reliable ROI data on ESG

While corporate silos and lack of leadership attention rated low as barriers to ESG, they are in fact two of the greatest barriers to measuring the ROI of ESG initiatives. When underlying data is either nonexistent, incomplete, late, or unreliable, and when leadership disagrees about the importance of ESG (surely a governance issue), then the financial numbers on offer are irrelevant at best.

To build trustworthy data, the both investors and the C-suite must:

- Develop clear ESG objectives. For example, if logistics reduces its carbon footprint, does that offset a higher carbon footprint in operations? If a new, more energy efficient warehouse is proposed closer to suppliers but further from customers, is the carbon footprint for logistics considered in the proposal and, if so, does it also improve?

- Create consistency in internal measures. A blanket command to raise diversity by 10% has quite different effects depending on the area—a 10% improvement in diversity might involve 100 new hires in operations but only one new hire in finance.

- Make ESG a part of corporate values and then part of performance reviews. Does everyone on the leadership team agree on the meaning, purpose, and urgency of ESG initiatives? If, for example, different divisions have different perspectives on what constitutes bribery versus gifting, then an anti-bribery standard is difficult to enforce.

- Add a Supply Chain or Sustainability Officer or similar position to the decision-making team. Someone needs to take overall responsibility for ESG and tie together efforts in different divisions and functions. Often this role is delegated to the financial team. But to please investors, the financial team may, for example, have a bias toward offsetting greater energy consumption by citing greater diversity of workers—even though the two initiatives have nothing in common.

- Eliminate silos. Siloed data can result in uninformed decisions with unexpected consequences. For instance, suppose engineering makes changes to improve efficiency, such as reducing packaging to increase truck capacity. However, now that more products may be placed on a truck, the load may surpass weight limits, resulting in the need for a second truck and negating the initial efficiency gain by increasing fuel consumption.

- A cultural matrix assists in creating values that are understood by everyone in the organization and can be used as a basis for performance review.

- Capacity, capability, and supplier optionality help to ensure that all choices take ESG into account, so that the “inside-out perspective” is maintained.

- An ORCI (owner, responsible, consult, inform) analysis keeps everyone in the loop for following through on ESG decisions and clarifies roles and responsibilities.

- Master schedules, process trackers, dashboards, and similar tracking methods provide a visual picture of the progress toward ESG.

Enhancing end-to-end supply chain visibility into ESG initiatives:

Strategies and Approaches

For supply chain executives, obtaining a unified understanding of ESG data is just the starting point. To fully comprehend the real world impact of ESG initiatives, it's crucial to have comprehensive visibility across the entire supply chain. The interdependence of procurement, operations, logistics, and finance means that any alteration in one function can cause ripples throughout the entire chain, from suppliers to customers and beyond. With enhanced visibility, supply chain executives can ensure that they have the necessary oversight to not only make informed decisions on ESG initiatives but also effectively monitor their implementation and measure their impact on the organization's bottom line.

In addition, forward-thinking companies look beyond the supply chain at their supplier’s suppliers and at end-user behavior. As noted in the State of Green Business 2021, “In a circular supply chain, sourcing no longer focuses exclusively on virgin materials. As companies take responsibility for the entire lifecycle of their products, hazardous conditions in which a child disassembles a smartphone are as problematic as cobalt sourced using forced child labor in a conflict zone to make the smartphone in the first place.”3

With so many potential good and ill consequences, investors and the C-suite need a way to foresee how the entire plan-buy-make-move supply chain will react to potential initiatives before deciding whether to go ahead or not. Within the supply chain, opportunities for achieving a high ROI include cost control, upgraded efficiency and productivity, decreased waste, lower energy and water consumption, decreased risk of regulatory fines, and greater investor and customer loyalty. Those opportunities exist throughout procurement, operations, and logistics.

To ensure that ESG initiatives deliver the desired results, ongoing oversight and monitoring is crucial. This requires not just the use of the right metrics to measure success, but also having the right tools and processes in place to track progress. By utilizing supply chain simulation and twinning, and by giving ESG and supply chain leaders a significant role in decision-making, the C-suite can gain the necessary visibility and control to drive the implementation and achieve the desired outcomes of ESG initiatives.

Giving both ESG and the supply chain leaders a seat at the decision making table helps to ensure that ESG and its effect on the end-to-end supply chain are considered whenever you consider an initiative. ESG leadership also helps to prevent greenwashing, in which sustainability is extolled but never actually implemented. Greenwashing causes consumers, investors, and governments to lose trust in business practices. Are your manufacturing processes really environmentally friendly? Are your hiring standards truly equitable, diverse, and inclusive? Someone needs accountability for ensuring that initiatives actually enhanced your environmental, social, and governance practices as well as providing a return on investment.

Unleashing the power of ESG intelligence

through supply chain digital twins

Supply chain digital twins can play an important role in promoting ESG performance in the supply chain. Here are just a few topics to consider while advancing your analytics journey:

- Transparency. Digital twins can provide real-time visibility into the activities and operations of suppliers, enabling organizations to identify ESG risks and opportunities within their supply chains. This can help to ensure that suppliers are meeting ESG standards and to track progress towards ESG goals.

- Risk Management. By providing a comprehensive view of the supply chain, digital twins can help organizations to identify and mitigate ESG risks, such as the use of conflict minerals, exposure to environmental hazards, and labor violations.

- Compliance. Digital twins can help organizations to monitor and enforce ESG compliance within their supply chains. For example, they can be used to track the use of environmentally friendly materials and to verify that suppliers are adhering to labor and human rights standards.

- Continuous improvement. Digital twins can provide a foundation for continuous improvement of ESG performance in the supply chain. By using data and analytics, organizations can identify areas for improvement and track progress over time.

- Stakeholder engagement. For supply chain executives, supply chain digital twins offer an opportunity to enhance trust and establish credibility with key stakeholders through the provision of transparent and easily accessible ESG performance information. By utilizing this technology, supply chain executives can actively engage stakeholders in ESG initiatives and demonstrate the organization's strong commitment to sustainability.

Maximizing the ROI of ESG: The importance of asking the right questions

- Where should a company start its ESG journey: with environmental, social, or governance initiatives?

- What ESG actions will make a company most attractive to investors and other stakeholders: for example, community relations, board diversity, climate strategy, safety, or energy efficiency?

- What if a recession hits?

Improving ESG performance through enhanced operations

management: The SGS Maine Pointe approach

for measuring yield optimization, fuel conservation, and other key indicators resulted in inaccurate KPIs, poor performance, and higher fuel consumption

compared to industry standards. SGS Maine Pointe intervened by implementing an operations control center, developing an operational dashboard with vital

metrics, and ensuring business unit alignment on flight schedules and routes. This effort boosted fleet usage by 98%, decreased the need for costly

charters, and achieved significant improvements in fuel conservation, fuel efficiency, and carbon emissions reduction. These changes generated annualized

savings of 20%, including ESG contributions.

Are you ready to determine the true ROI of your ESG?

Each year, the number of CEOs who say that ESG has boosted their company’s performance has grown by double-digit leaps. Those CEOs understand that selecting causes based on the current hot topic is not enough: each initiative has real-world consequences that affect the entire plan-buy-make-move supply chain.

With a firm basis in data analytics, leader and organization improvement, and supply chain visibility through simulation and twinning, ESG initiatives achieve and contribute to EBITDA, growth, profit, and cash flow goals. Given trustworthy data, the C-suite can trace the effects of ESG and maintain oversight of its progress and ROI.

Sources

- https://www.weforum.org/agenda/2021/03/yes-esg-is-complicated-together-we-can-simplify-it/

- https://www.weforum.org/impact/stakeholder-capitalism-esg-re-porting-metrics/#:~:text=ESG%20reporting%20has%20been%20adopted,to%20make%20an%20impact%20yourself%3F&text=For%20the%20private%20sector%20to,common%20reporting%20system%20is%20essential

- https://www.spglobal.com/marketintelligence/en/documents/state_of_green_business_2021.pdf

Share

Share  Print

Print Download

Download