How we work with you

Maine Pointe delivers compelling results

Analyze

Implement

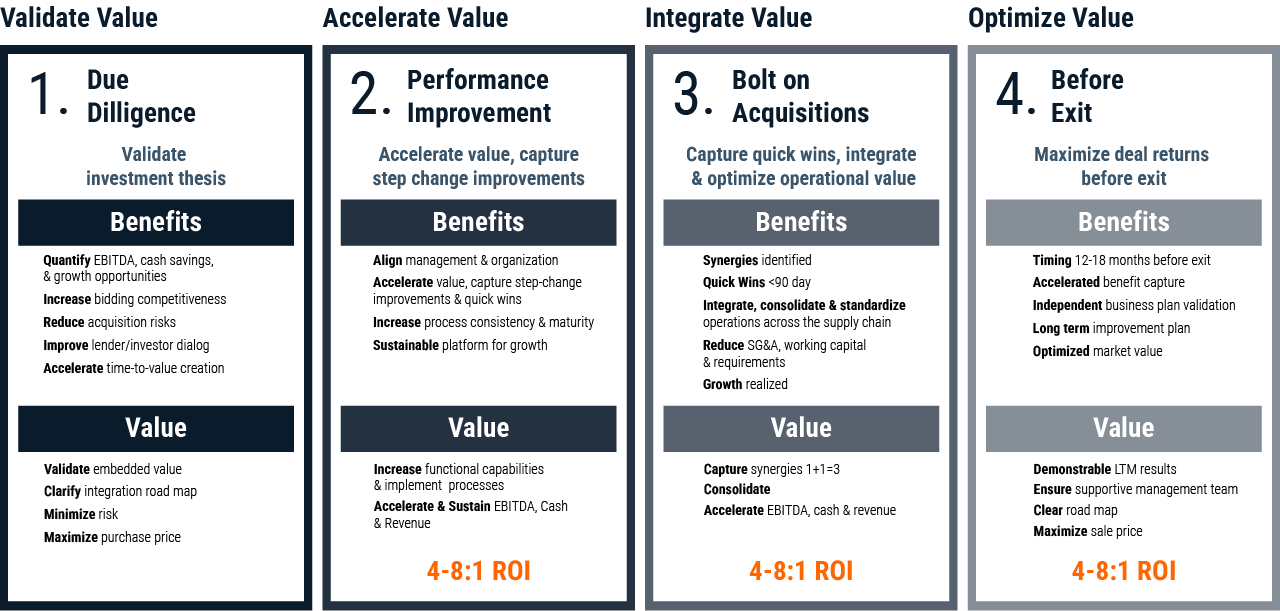

Improving competitiveness, confidence, integration, synergy savings, and time-to-value realization

Maine Pointe’s hands on, accelerated approach to due diligence uncovers value opportunities and positions buyers to capture supply chain and operations-oriented value creation opportunities post-acquisition.

Our supply chain experts combined with our digital and systematic approach to diligence helps corporate and private equity buyers become smarter in their buying decisions. The validation and refinement of the investment thesis enables buyers to accelerate the integration and time-to-value realization process.

Post engagement our cross-functional integration, change management and data analytics capabilities are critical components to driving synergy savings and associated integration and value creation benefits aligned to your financial goals

This approach is integrated into our end-to-end supply chain and operations transformation approach called Total Value Optimization.

Our comprehensive set of pre- and post-acquisition implementation services helps improve your confidence and competitiveness and accelerate integration and time-to-value realization.

We break through functional silos and take you to high performance

Most supply chains operate in functional silos and struggle to keep pace in today’s rapidly changing world.

Our goal?

To help you deliver the greatest value to customers and stakeholders at the lowest cost and risk to business. We call this Total Value Optimization.

Driving measurable and sustainable change

Maine Pointe Client Testimonial Videos

The engagement generated significant measurable results, including transformational change, forward looking KPIs to predict the business, margin improvement, and value to customers and shareholders.

Brad Feldmann, CEO, Cubic

The Maine Pointe engagement helped us drive the highest level of revenue ever and drove measurable improvement in profitability through manufacturing rationalization and sourcing optimization.

Kirk Goins, CEO, Luminator Technology Group

“Maine Pointe consultants, working side-by-side with our team, elevated our competitive edge in the market place and positioned our company to absorb additional work through sales via organic growth or mergers and acquisitions."

Mike Lane

CEO, Nevco

Have a particular business challenge you'd like to address?

Submit this contact form to speak with one of our executives.