The O&G Industry Moves into 2024 with Favorable Signs—and Risks

As 2023 transitions into 2024, positive signs are emerging for oil and gas companies, with increasing production, fewer material shortages, and abating inflation. However, even good news comes with caveats: more production, for example, means increased competition for both labor and materials. Oil and gas companies will need to look toward technology implementation, strategic sourcing, and logistics optimization to ensure they remain competitive and avoid trending risks in 2024.

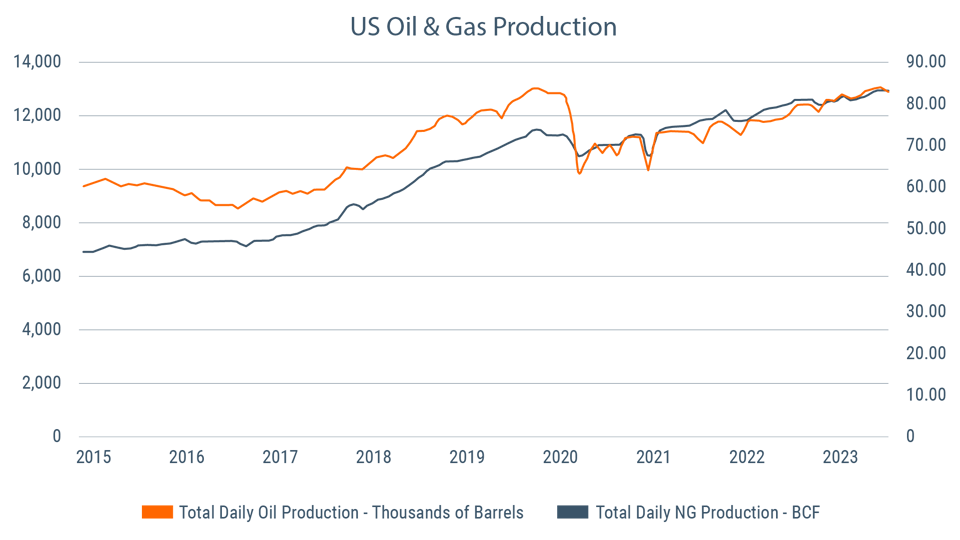

In 2023, domestic production of oil and gas saw increases of 9% year-over-year for oil and 4% for gas. With both domestic and global demand expected to increase, production will likely also continue to climb. In fact, the US hit an all-time production record in December 2023, producing 13.3 million barrels of oil per day and eclipsing the previous record set just before the pandemic.

Source: EIA

Despite deflation in some categories and operators continuing to focus on capital discipline, operating cash flow has been declining quarter to quarter over the past year. However, CAPEX has increased due to equipment/labor inflationary pressure, highlighting the need for companies to strategically manage their supply chains. Oil prices have stabilized in the $70-$80 per barrel range and are expected to maintain that level through 2027. As a result, it is expected that increased domestic and global demand will intensify competition for the best quality equipment, the most productive labor/crews, and other resources, even more notably if natural gas prices rebound.

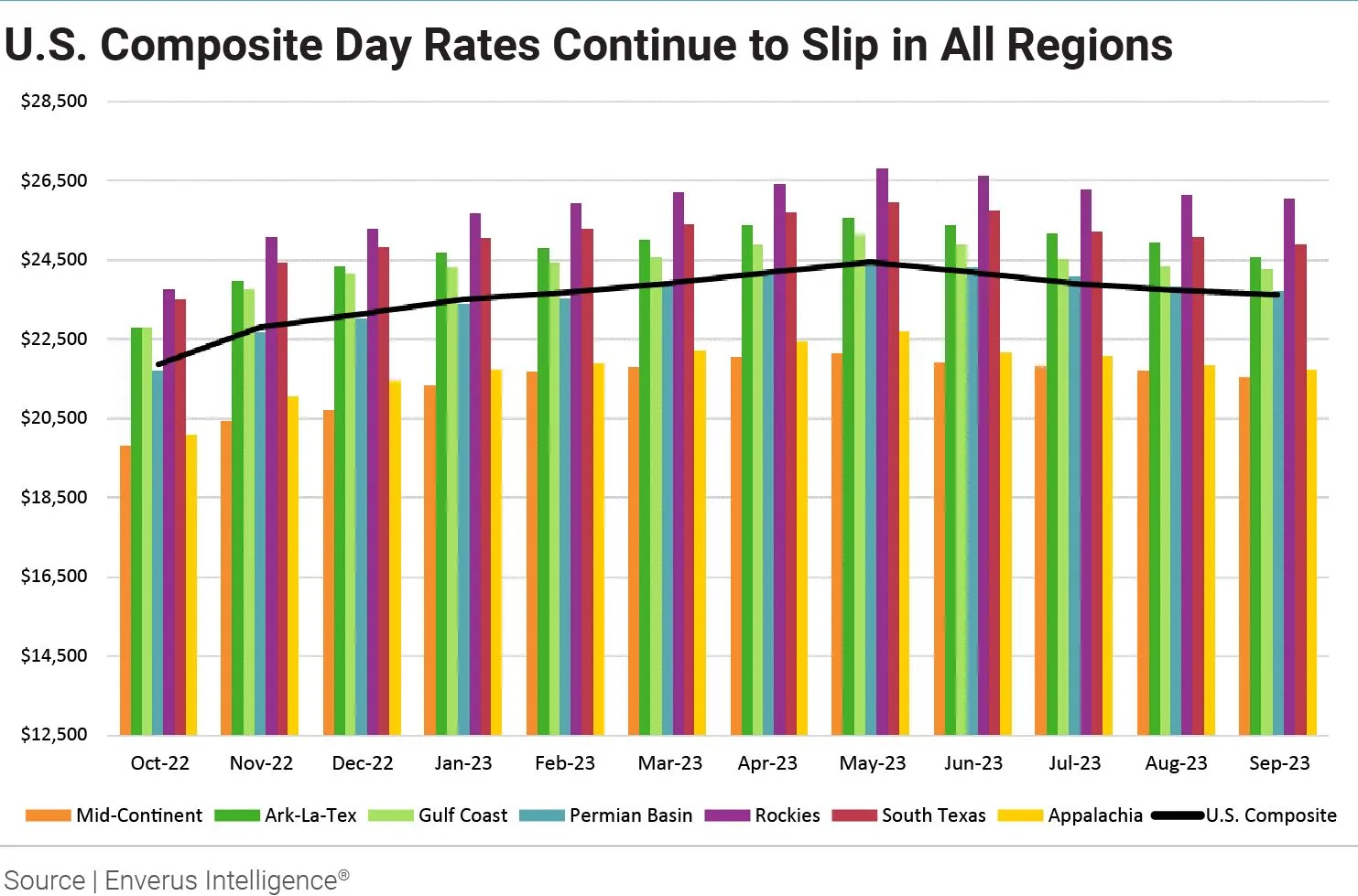

Reductions in drilling rigs and rates are continuing

There has been a sustained reduction in the number of onshore drilling rigs throughout 2023, with the number of rigs in operation declining by >20% YoY. The past 6 months have also seen a reduction in rig day rates, across all operating regions, with an aggregate day rate reduction of >6%.

Moving into 2024, it is projected that the decline in drilling rigs will stabilize, with the potential to see slight increases in the second half of 2024; however, rig rates will likely remain lower until rig utilization reaches 90% (it is currently <80%). The Permian Basin will continue to lead the U.S. Lower 48 market, accounting for about half of all drilling activity in 2024.

Major gas pipeline projects (such as the Matterhorn Express and Kinder Morgan’s Permian Highway Pipeline Expansion), which are both scheduled to come on stream in the next year, will increase accessibility to the Houston market and LNG facilities, as well as help operators mitigate flaring and conform to ESG expectations. While projects like these will provide an outlet for increased natural gas production from the Permian Basin, their impact on drilling will not be immediately evident, so any resulting increase in rig count would likely be felt towards the end of 2024 or beyond.

Motivations behind M&A activity are changing

The current environment is also changing the primary motivation behind the majority of the recent M&A transactions. Access to well inventory, especially high quality Tier 1 inventory, has risen in importance, as opposed to motivations in previous M&A cycles, which were more focused on cost and operational efficiencies. M&A news has been dominated by two mega-deals, ExxonMobil’s acquisition of Pioneer Resources and Chevron’s acquisition of Hess. There have been several other significant (multibillion-dollar) transactions where companies sought to enhance their position within a specific basin or gain access to a new area, with 2023 having the largest M&A activity by dollar value in history.

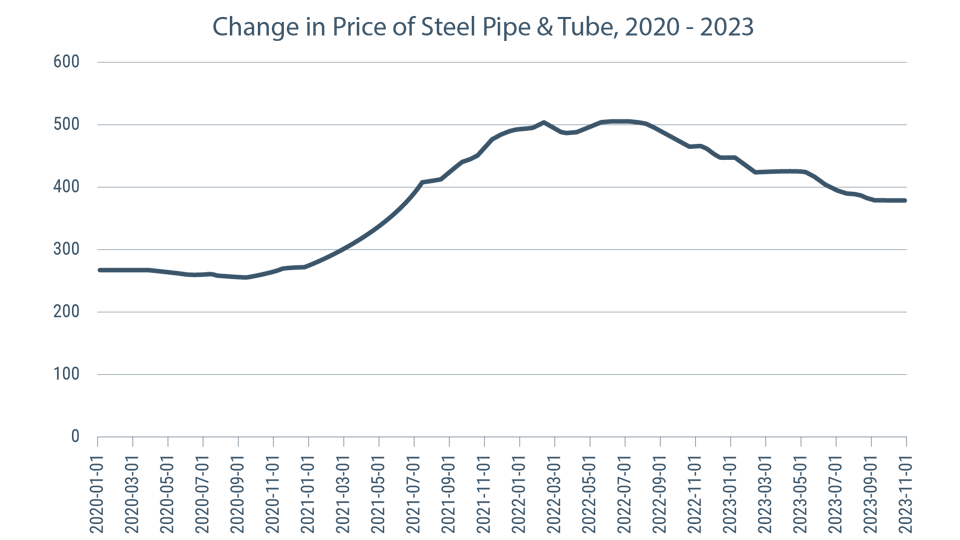

Some material shortages are easing

As we enter 2024, some of the material shortages and supply issues, and seemingly never-ending inflation, that were prevalent during the past couple of years have eased to a degree. Certain commodities that have a heavy impact on the O&G industry have even seen reductions in price over the second half of 2023. Steel, in particular, has seen significant deflation, with the price of steel pipe and tube decreasing about 25% from the high it hit in mid-2022 (after it had seen inflation of >88% between the beginning of 2020 and mid-2022).

Three key initiatives will help build supply chain resilience

Properly addressing a company’s supply chain requires cross-functional cooperation and collaboration. It is imperative that operations, procurement, logistics, and planning all work together to build supply chain resilience, with a focus on the following key initiatives to maintain competitiveness as we move into 2024:

- Strategic procurement mitigates raw material issues

A key aspect of strategic procurement is building and maintaining strong supplier relationships. Once a company commits to strategic procurement, it can implement strategies that strengthen the entire supply chain.

A company looking to reduce the cost of steel called in SGS Maine Pointe to diversify its supply base, increase visibility into costs, standardize its contracts, improve supplier relations, and set up index-based pricing. As a result of these strategic procurement changes, the company achieved annualized savings of $15 million and a 6.7% EBITDA improvement.

- Technology enables data-based decision making

Data analytics tools process large volumes of data while identifying real-time performance trends, anomalies, and opportunities for both technical and commercial optimization across a company’s operations.

A major energy company wanted to invest in carbon capture, utilization, and storage (CCUS) technology. However, the company was frustrated by the lack of information available on CCUS products and their suppliers. By using multi-dimensional data analytics and benchmarking, the SGS Maine Pointe team identified potential technologies and also provided a playbook for finding the perfect technology partner.

- Logistics optimization helps with labor and resource allocation

Rather than hire or develop internal capability, companies may turn to specialized logistics and materials management companies providing a variety of services, including freight transportation, order fulfillment, and warehousing. Using a third party logistics supplier (3PL) provides value by allowing an operator to focus on their core business. It also simplifies the supply chain by having one strategic partner, rather than managing a number of different logistics providers, and potentially results in significantly reduced materials management and warehousing expenses.

A gas processing plant depended on rail for 80% of their logistics, yet could not see a clear way to meet their goal of tripling capacity quickly. SGS Maine Pointe discovered that poor staging and load sequencing had resulted in each car being handled six times. Through logistics efficiencies, additional shifts, and new operating tools, the 3PL railroad company serving the plant delivered a 43% increase in capacity, 50% reduction in the number of times cars were handled, and 24/7 switching coverage.

Closing thoughts

With stabilized pricing and ongoing strong demand, the market for oil and gas companies in 2024 is favorable; however, it’s critical that companies don’t fall into complacency about the very real competitive risks. With tactics such as strategic procurement, technology implementation, and logistics optimization, oil and gas companies can stay competitive and deliver against their short and long-term financial goals.