PE Lifecycle: Earlier is better, but is it ever too late to bring in a supply chain and operations consulting partner?

The Private Equity Landscape H1 2019

We saw a significant decrease in global M&A activity in the first half of 2019. This can largely be attributed to greater market volatility, trade tension between US & China and the looming threat of Brexit. During the same period, US M&A value beat the odds to rise by 9% compared to the first half of 2018. However, it's a different picture where volume is concerned, with the number of deals falling by 21%.

Against this backdrop, fundraising remains at unprecedented levels and private equity firms have accumulated trillions of dollars. This availability of capital has pushed competition and valuations to exceptional heights, with multiples averaging about 11 times EBITDA in the US and Europe over the past 12 months. In this challenging and volatile global market, it is more important than ever for PE firms to enter into transactions with their eyes wide open and a clear exit strategy. With PE firms entering investments at an all-time high and expecting to exit in a lower multiple environment, the question will be: When is it the right time to invest in creating operational value to drive EBITDA, cash and growth?

The early bird

There's no disputing the fact that the first few months when a PE firm takes over a business are pivotal to setting the pace of change, getting KPIs in place and establishing a strong relationship with the company's management team. In response, firms look to take concrete steps in the early part of the investment lifecycle to clearly establish what they need to do to drive value from the deal.

With time of the essence, it's becoming more common for firms to begin work on a 100-day plan before they even have ink on the deal.

Typically, the plan has four parts:

- Review of cost -- an aggressive effort to see where money is being spent and how to reallocate expenses for the best return

- Strategy to build an organization that is capable of delivering the defined value (right people, culture, processes)

- Market analysis -- understand the landscape the company operates in, underlying trends and challenges and its customer base

- Road map -- consisting of metrics and targets the board can use to evaluate progress as you move towards exit

To develop this, you need a clear field of vision across the organization's buy-make-move-fulfill supply chain from suppliers' suppliers through to customers' customers. Driving value and realizing the full potential of your assets requires a Total Value Optimization (TVO)TM approach, focused on creating a synchronized, agile, end-to-end supply chain using advanced data analytics tools to deliver the transparency you need to see where the opportunities lie.

But it's never too late

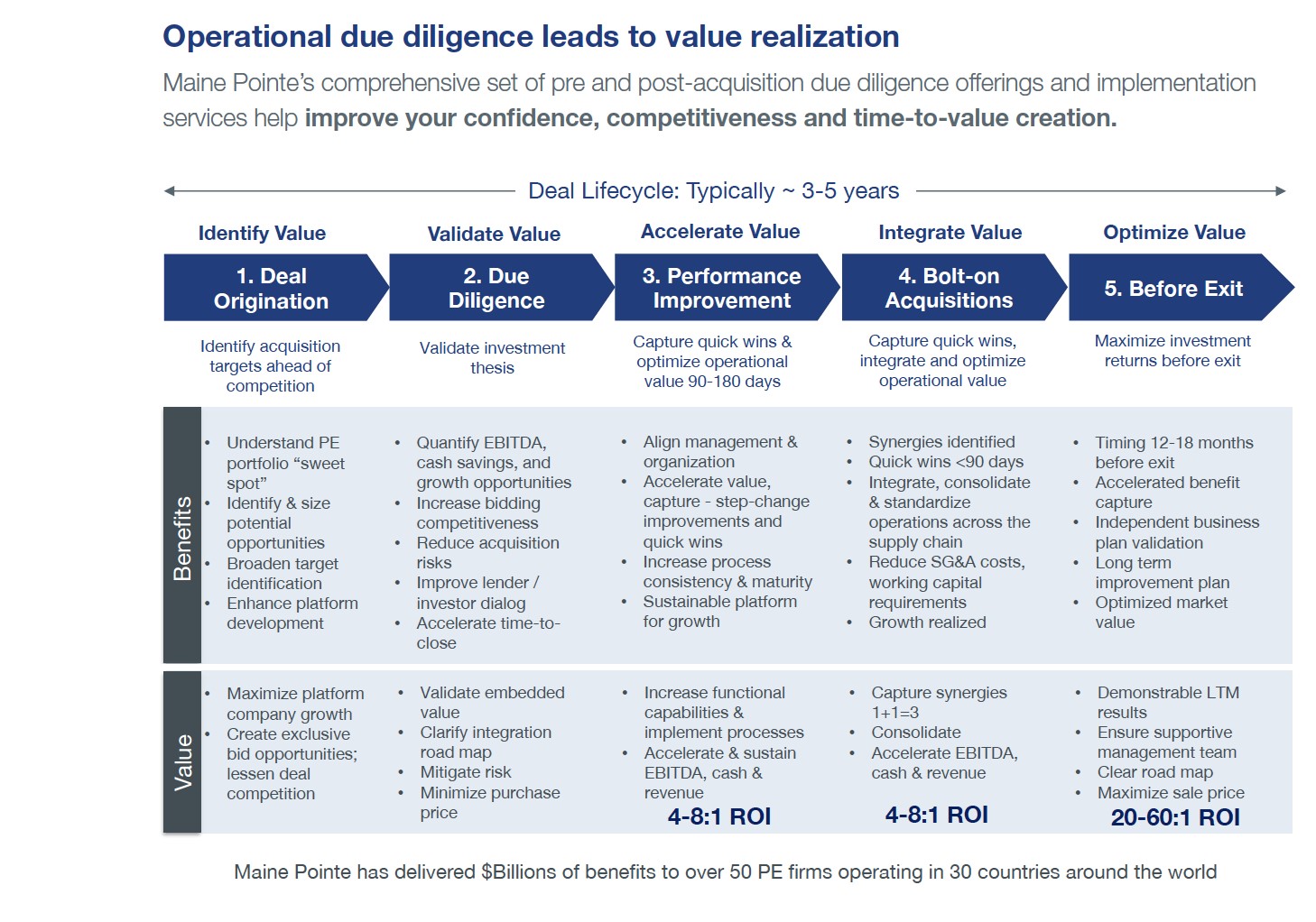

Bringing in an operating partner at due diligence is the surest way to guarantee you're making the right buying decision and will be able to start generating value from day one. In our experience, firms that engage a partner early on significantly impact their investment thesis by identifying critical supply chain improvements and exposing areas of operational risk. Ultimately, this increases bid competitiveness and mitigates investment risk.

However, in reality it is often the case that an operating partner is not brought in until well after the transaction has closed. Even at this stage in the lifecycle, with the right approach, you can still drive substantial value across the supply chain and significantly increase exit value. Maine Pointe has delivered transformational results to PE clients and their portfolio companies across the PE lifecycle.

TVO in action: Delivering value across the PE lifecycle

Pre-acquisition due diligence

A PE firm had entered a competitive acquisition process to take a publicly-traded audio and technology consumer products company private. Maine Pointe was brought in early for the operational due diligence to help identify and size potential opportunities in the supply chain for value creation. The information we provided gave the client the analytical insights to raise their investment commitment and ultimately acquire the company successfully. Post-deal, the PE firm asked Maine Pointe to conduct an in-depth analysis and work with the CEO to help realize the opportunities previously identified. As a result, the company almost doubled EBITDA and achieved a 6:1 project ROI. (Maine Pointe Case Study CS194)

Driving accelerated synergies post-acquisition

Following a due diligence which uncovered millions of dollars in supply chain synergies and opportunities to quickly improve operating costs Maine Pointe served this PE-owned contract manufacturer with an accelerated plan for time-to-value creation in procurement and logistics. Our focus was on minimizing some of the risks commonly associated with realizing synergies post M&A and to quickly find new areas of savings that had not been identified due to the limited information provided during due diligence. We delivered the first 20% EBITDA savings within 4 weeks, 50% annualized savings improvement within four months and developed a road map to drive $3M in unexpected additional synergies.

Post-acquisition portfolio company value creation

Maine Pointe successfully completed 13 engagements within one PE firm's portfolio, spanning procurement, logistics and operations. This led to an increase in the valuation of their portfolio by over $700 million.

Increasing value in a portfolio company near exit

This PE-owned specialty materials and specialty chemicals company wanted to increase multiples of a business unit. The company had already implemented a number of internal improvement initiatives, which had resulted in some savings. Maine Pointe was engaged to deliver additional savings at an accelerated rate. As the engagement was in its final stages, the private equity firm began the process of putting the company up for sale. Over the following five months, Maine Pointe assisted the portfolio company and their PE and financial partners in preparation for sale and a series of due diligences. Maine Pointe worked closely with the investment bank to create the appropriate content and materials for the company's sales package. Subsequently, a US-based private equity firm acquired the company's business division, delivering a 60:1 ROI at exit in less than one year.

In the end, there is no “wrong“ time to bring in an operational consulting partner to help drive value. However, we believe change sticks when it happens early and fast and this is highlighted in your investments quality of earnings.

Maine Pointe is an operational, implementation-focused consulting firm that works with private equity firms and their portfolio company executives around the world to rapidly increase EBITDA, cash flow and growth.

Our teams of industry specialists deliver implementation services that drive sustainable benefits across the areas of procurement, logistics and operations to enable growth in both asset intensive and asset light businesses. We have delivered a ROI in excess of 4:1 for over 50 PE firm and 100 portfolio companies worldwide.

About Us

Maine Pointe, a member of the SGS Group, is a global supply chain and operations consulting firm trusted by many chief executives and private equity firms to drive compelling economic returns for their companies. We achieve this by delivering accelerated, sustainable improvements in EBITDA, cash and growth across their procurement, logistics, operations and data analytics. Our hands-on implementation experts work with executives and their teams to rapidly break through functional silos and transform the buy-make-move-fulfill digital supply chain to deliver the greatest value to customers and stakeholders at the lowest cost to business. We call this Total Value Optimization (TVO)™.

Maine Pointe's engagements are results-driven and deliver between 4:1-8:1 ROI. We are so confident in our work and our processes that we provide a unique 100% guarantee of engagement fees based on annualized savings. www.mainepointe.com